30 Jan The 4 LTC OPTIONS + life Presentation

OUR VISION:

To bring financial literacy to our clients through proven principles of wealth building, protection, and transfer. To guide our clients to a place of true peace of mind and financial independence.

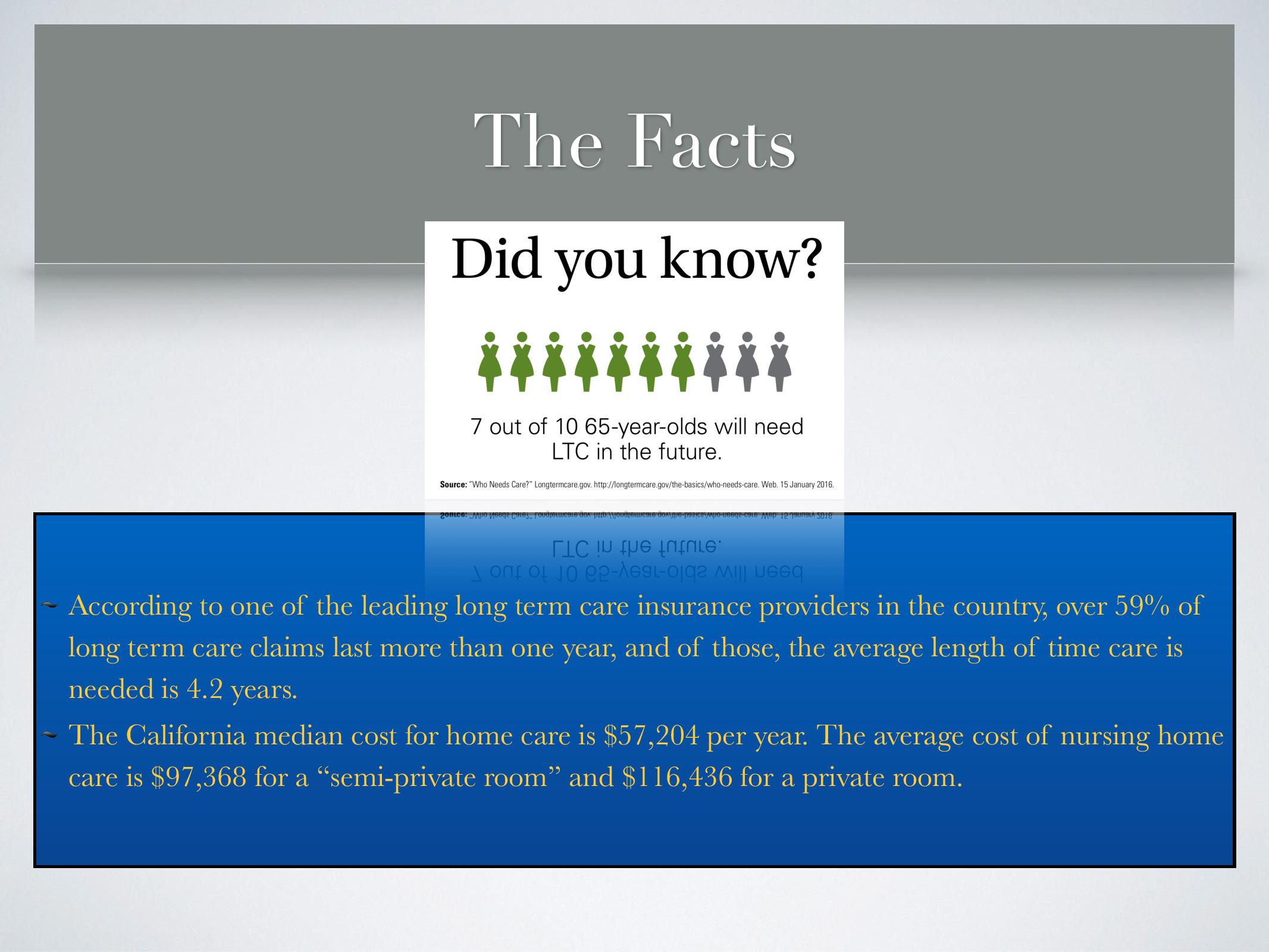

There’s another epidemic happening right now, and has been for many decades…

FINANCIAL STRUGGLE AND STRESS DUE TO LACK OF KNOWLEDGE.

TODAY’S TOPIC:

The 5 Top ways t0 Protect family and assets in retirement

WHAT IS THE “GREAT RETIREMENT INCOME GAP”??

A. Extended Health care costs

#1. THE ALL-TOO-POPULAR APPROACH…

The Ostrich Strategy

It works something like this:

This option is:

The easiest to do now

The most painful later

The most expensive

1. PURE LONG-TERM CARE INSURANCE The top 3 REAL options…

3. THE HYBRID OPTION

2. PURE LIFE INSURANCE WITH A LTC OR CHRONIC ILLNESS RIDER

4. LTC ANNUITIES

1. PURE LONG TERM CARE INSURANCE

Benefit amount is typically based on a cost per day or month for a set period of time.

There is a time deductible called an “elimination period” – typically 60-120 days.

Rating based on Health, age, and gender

Pros

• Most straightforward solution – Get the most for your dollars in specific long term care protection

• Can be surprisingly affordable

• Specific riders for increasing your benefit over time, and customizing benefit payout.

Cons

• If you don’t need end up needing care, the policy doesn’t do anything else for you or your family – no death benefit, no cash value.

• Carrier reserves the right to increase premiums (However rare)

2. LIFE INSURANCE WITH CHRONIC ILLNESS/LTC RIDER

Typically allows 50-75% of the death benefit to be used for LTC needs Some IULs allow 100% access to death benefit, but benefits can fluctuate

Triggered by the same things that trigger LTC insurance

Pros

• Makes sure your family is paid no matter how you pass away

• It’s a cost-efficient way to cover this risk and multitask your dollars.

• Guaranteed premiums

• Could be designed to build cash value as well

Cons

• May not provide as much care for your dollar specifically for LTC

• Is not as customizable for LTC purposes

• If you use it for care, you will deplete the life insurance benefit for your heirs.

3. HYBRID LIFE OR ANNUITY LTC POLICY

Allows 100% of the benefit pool to be used for death benefit or LTC needs Triggered by the same things that trigger LTC insurance Builds guaranteed interest on the cash value growth Can receive qualified funds (IRA, 401k, etc.) or non-qualified

Pros

• Makes sure your family is paid no matter how you pass away, and builds cash that can be used for a variety of purposes

• It’s a very effective way to cover this risk and multitask your dollars no matter your situation.

• Guaranteed premiums

• Continuation Rider ensures benefits NEVER run out.

Cons

• Will provide lower daily or monthly benefit amount for care for your dollar specifically for LTC, compared to pure LTC ins.

• If you use it for care, you will deplete the life insurance benefit for your heirs. You should plan to have another life insurance policy, ideally.

4. ANNUITY LTC POLICY

Designed to create income for retirement, then multiply (typically double) it for the purposes of paying for LTC Triggered by the same things that trigger LTC insurance Easier to qualify for than the other 3 options Can receive qualified funds (IRA, 401k, etc.) or non-qualified

Pros

• Easiest to qualify for

• Has a death benefit

• Puts your money in a safe place where it can grow and contribute to your retirement income needs

• Continuation Rider is available in some situations – ensures benefits NEVER run out.

Cons

• No multiplied death benefit

• Limited options and riders

• Limited funding options (usually requires lump sums)

Life Insurance for Elderly and/or Heath-Challenge

1. Final Expense Life Insurance:

This unique product can be issued same-day. They ask few or no health questions, have no exam, and are designed to cover the immediate final expenses.

Typically up to $35,000 death benefit

Can add children, spouse, and AD&D for very little cost

Can be guaranteed-issue!

Can build cash value

Permanent, guaranteed death benefit and guaranteed level

premiums

Q & A

Death benefit features:

1. Tax-free to beneficiaries

2. Can be used for anything – no strings attached

3. Can be fixed, growing, or decreasing

4. Some policies feature “living benefits”

1. Critical injury, Critical illness, Chronic illness, and Terminal illness

DEATH BENEFIT USES:

1. Income replacement

2. Fund final expenses

3. Debt payoff – Mortgage, Student loans, auto loans…

4. Wealth transfer – Inheritance

5. Key employee/owner replacement expenses

6. Exit strategies

CASH VALUE FEATURES & USES

• Typically pays guaranteed 4% (plus dividends for mutual companies or “participating policies”)

• Emergency Fund or any other short-term savings goal

• Retirement supplement (i.e. L.I.R.P)

• Financing source replacement

• Multi-tasking dollars

• Supplement or pay premiums

FINAL IMPORTANT NOTES

WHAT NOW? WHAT’S THE NEXT STEPS?

Go to www.prepared-protected.com

to set up a time at your convenience

• Set up a time for a brief (10-15 min) talk with me

to see what options would work for you.

No Comments