27 Jan LIFE INSURANCE TYPES AND USES

Life Insurance types and uses presentation for KAM webinar

Wealth Strategies That Really Work

Let’s Talk Life insurance…

Two main categories of insurance:

Term and Permanent

Term Insurance

1. Level Term: Fixed death benefit, fixed time period, no cash or intrinsic value – pure protection only. Least initial cost. A.R.T – Annually renewable term

5 – 30 year terms To specific age (65, 100, etc.)

2. Decreasing Term Typically sold to compliment a mortgage payoff Many term policies have convertibility options

Permanent Insurance

Cash Values are 100% liquid Cash grows tax-free and is accessible tax free (Think Roth IRA on Steroids)

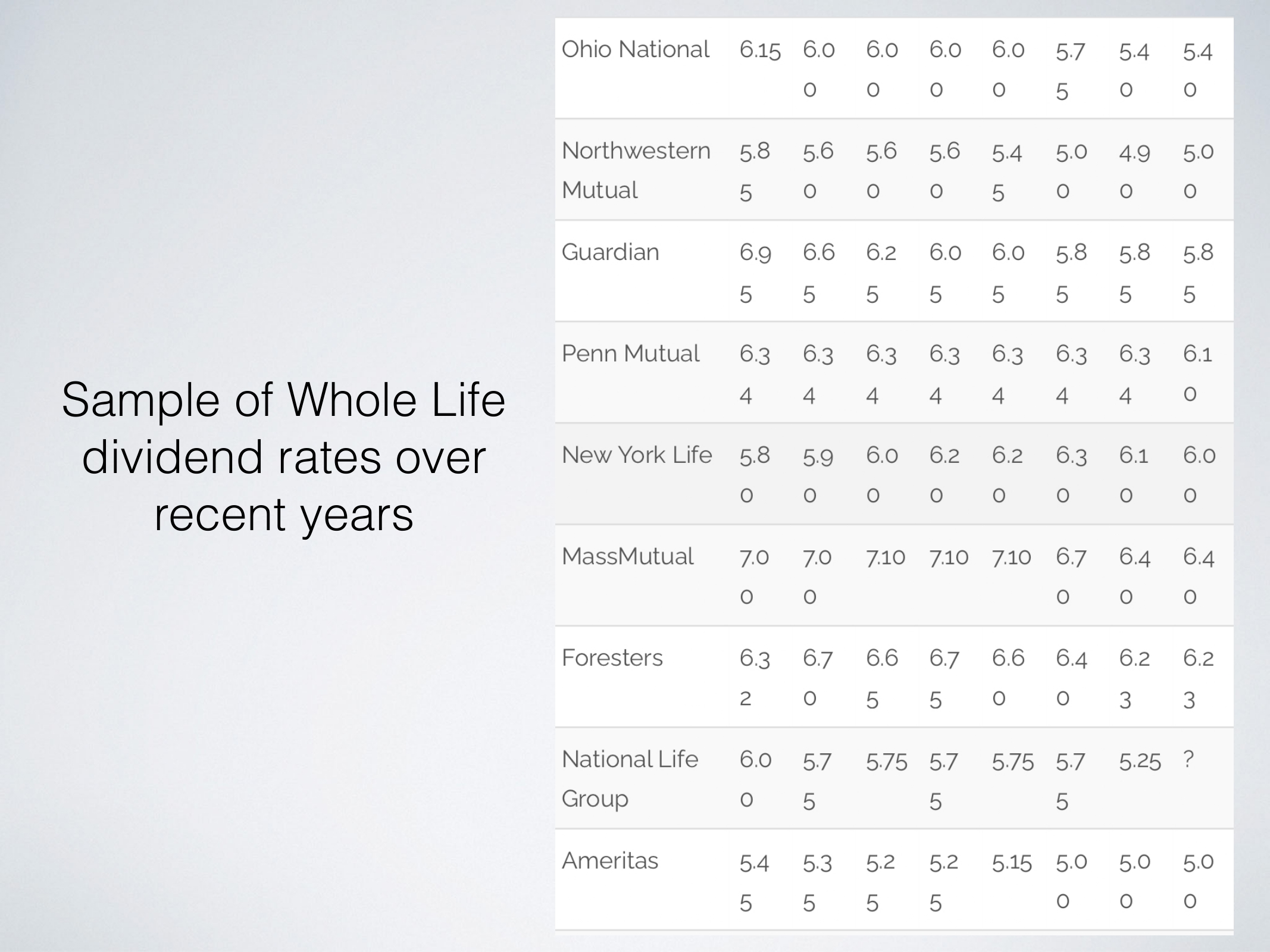

1. Whole Life: Meant to last the insured’s entire life – guaranteed payout. Builds cash value and death benefit. Qualifies as an asset. Guaranteed premium, fixed costs, stable dividend crediting. Death benefit typically increases over time

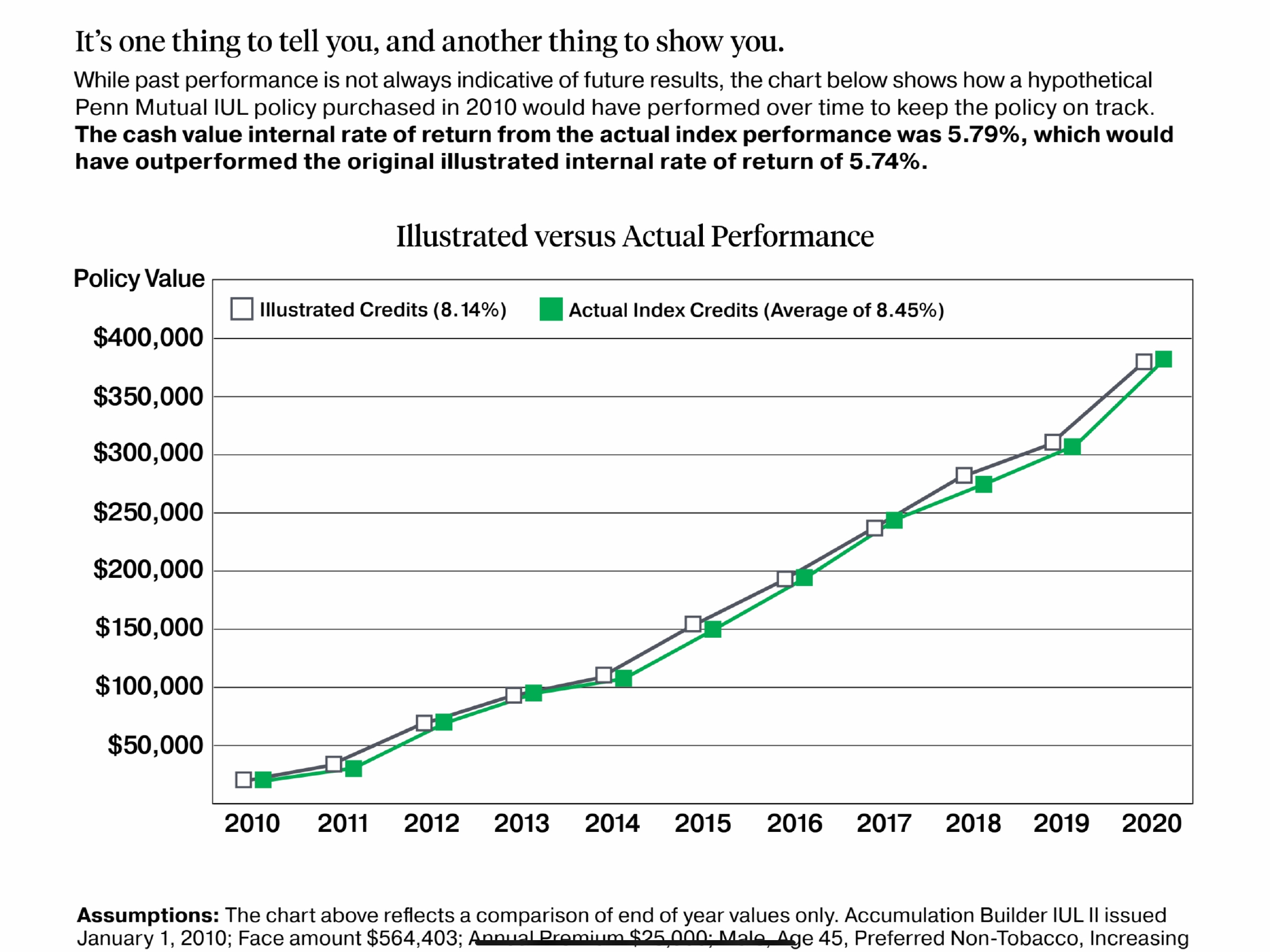

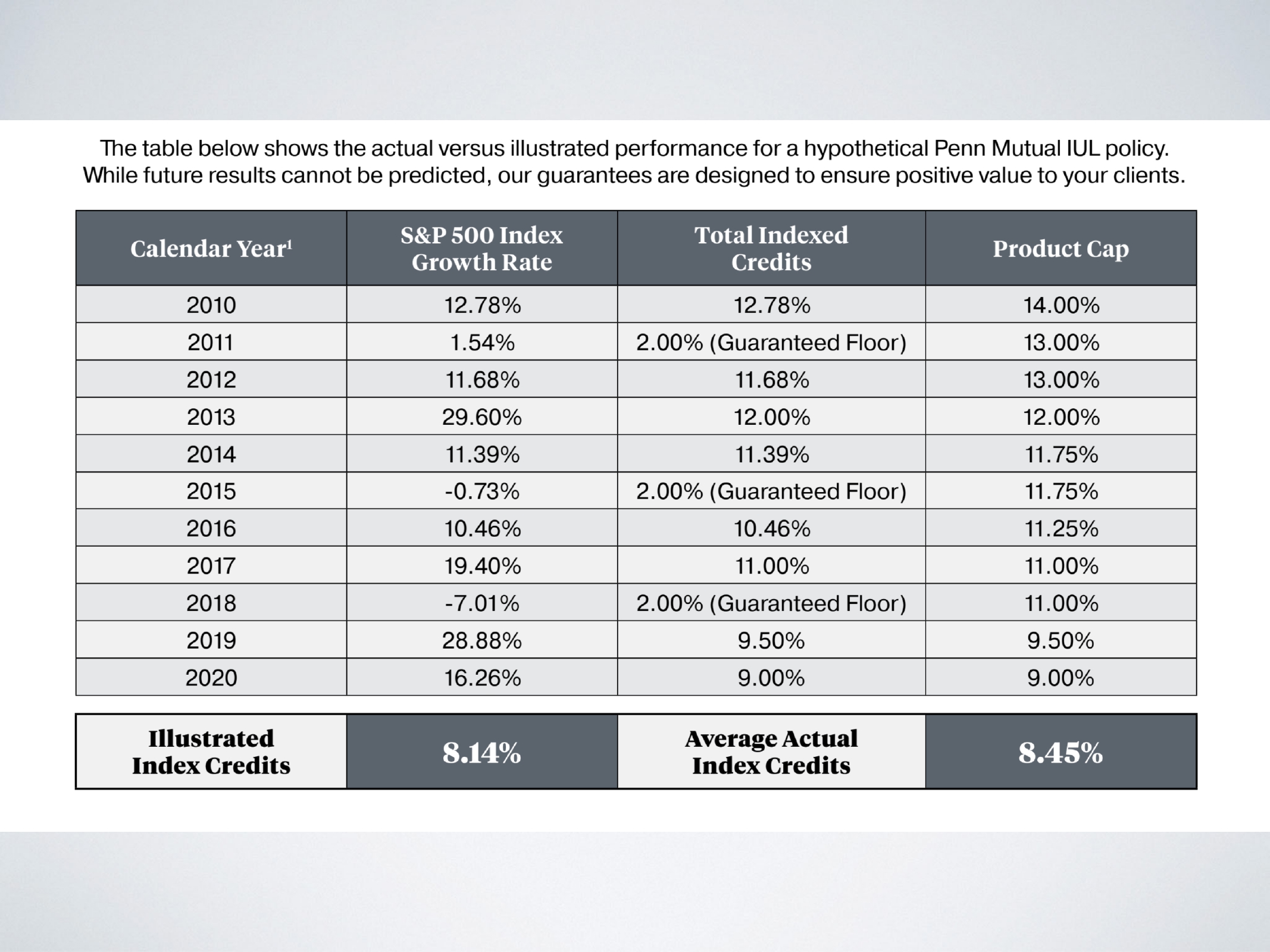

2. Universal Life/ Indexed UL: Designed more for accumulation with more flexibility. Also less guarantees – costs and returns change. More flexible premiums Typically based on an annual renewable term platform Earnings can be tied to a market index with guaranteed minimum return

3. Variable Universal Life – Invests in the market, can take losses and gains Typically based on an annual renewable term platform Funds are directly invested in a separate account that is fully exposed to market gains and losses.

About Luke Kibler

Death benefit features:

1. Tax-free to beneficiaries

2. Can be used for anything – no strings attached (Unless it is on collateral assignment)

3. Can be fixed, growing, or decreasing

4. Most policies feature Accelerated Benefit Riders (ABRs) otherwise known as “living benefits”

1. Critical injury, Critical illness, Chronic illness, and Terminal illness

Death benefit Uses:

1. Income replacement

2. Fund final expenses

3. Debt payoff – Mortgage, Student loans, auto loans…

4. Wealth transfer – Inheritance, gifts to charities, etc.

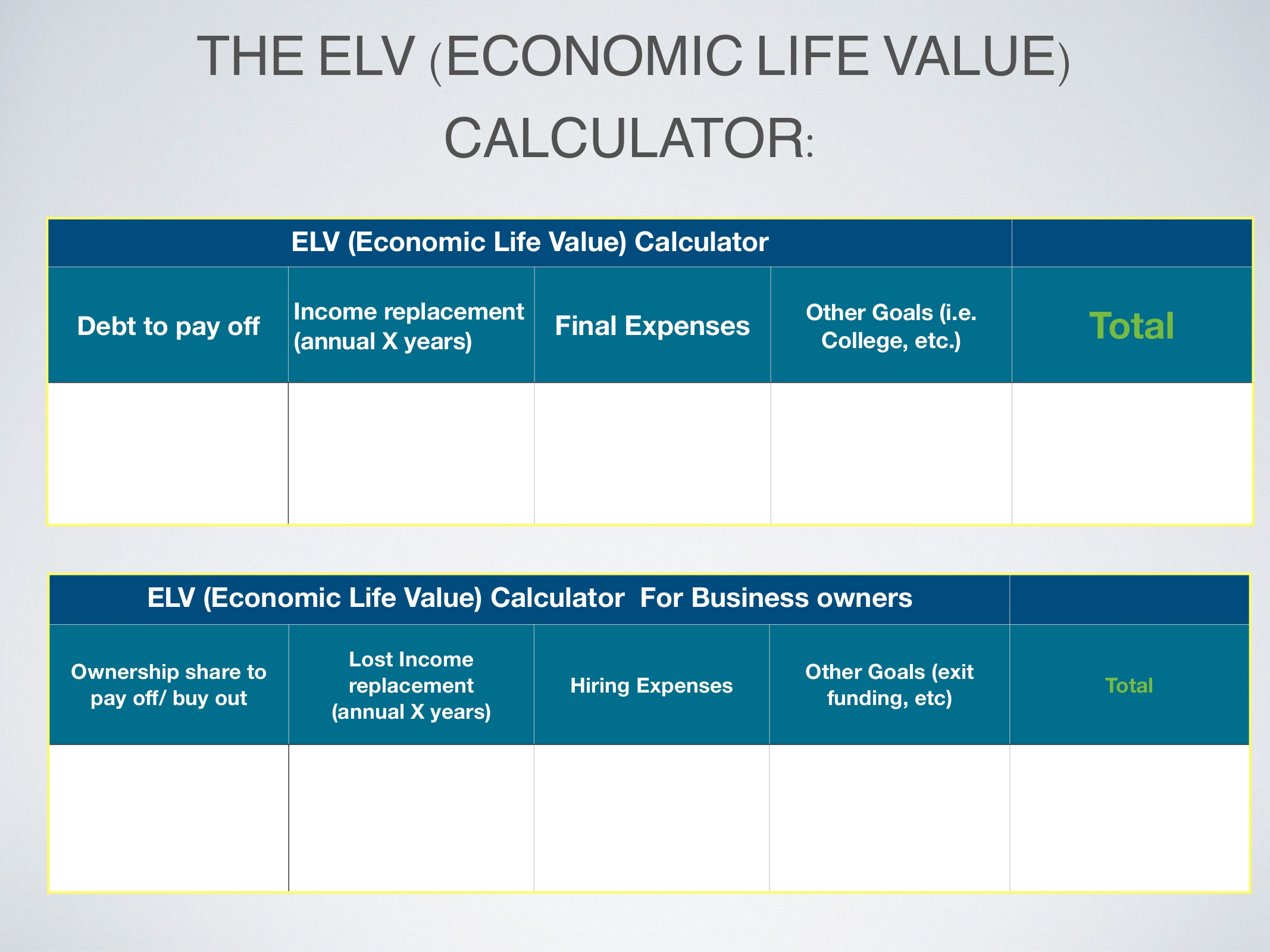

How much life insurance do I need?

A Better Question:

How much do you want? (AKA: What do you want it to accomplish in your financial life?)

THE ELV (ECONOMIC LIFE VALUE) CALCULATOR:

Death benefit Uses (business):

1. Buy Sell Agreement funding

2. Key employee/owner replacement expenses

3. Retirement or Exit strategies (Executive bonus, LIRP, Buyout, etc.)

Cash Value Features & Uses

• Typically ROR 4%-6% over time (dividends and interest for mutual companies or “participating policies”)

• Emergency Fund or any other short-term savings goal

• Retirement supplement (i.e. L.I.R.P)

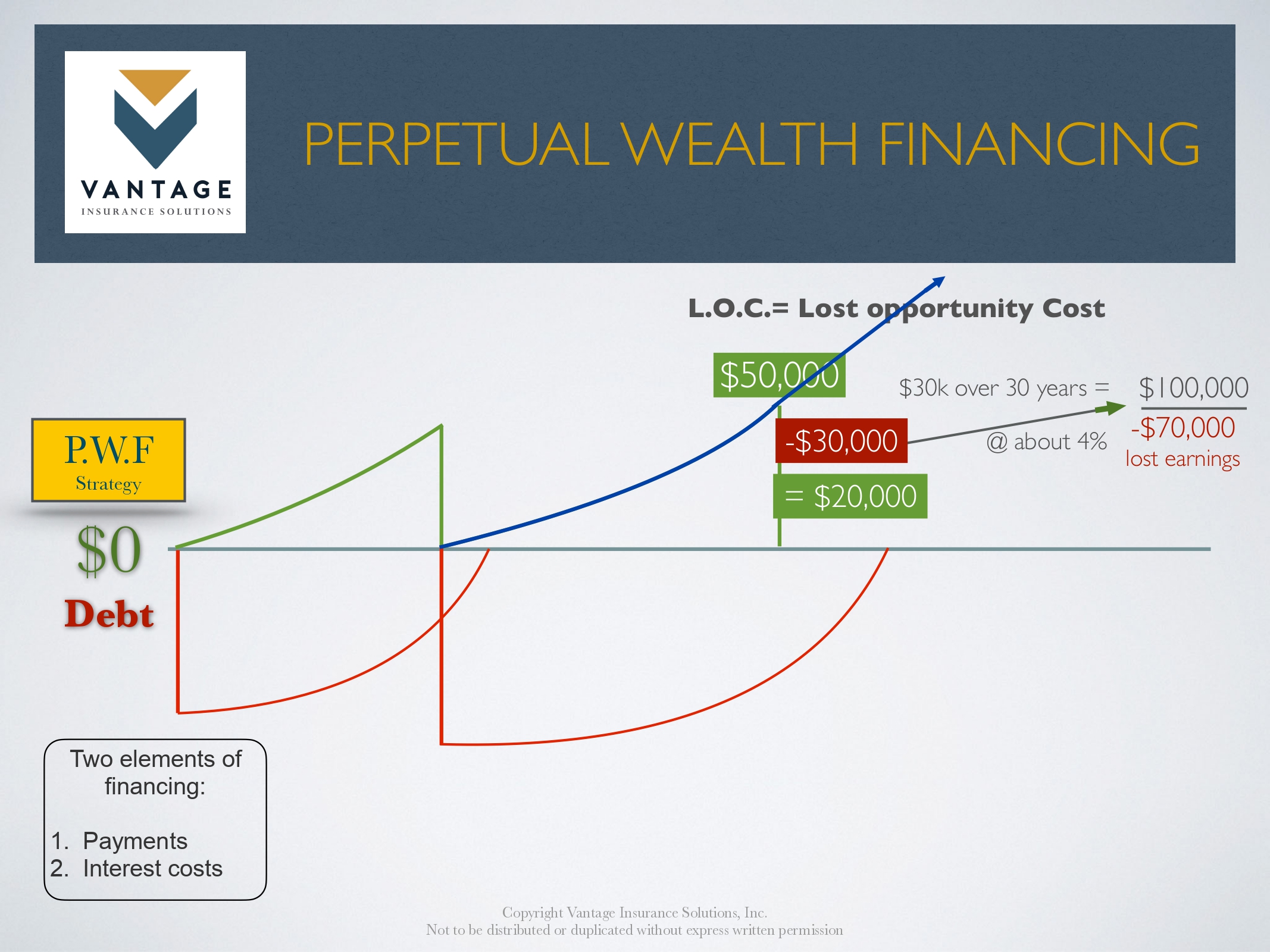

• Financing source replacement

• Multi-tasking dollars

• Supplement or pay premiums

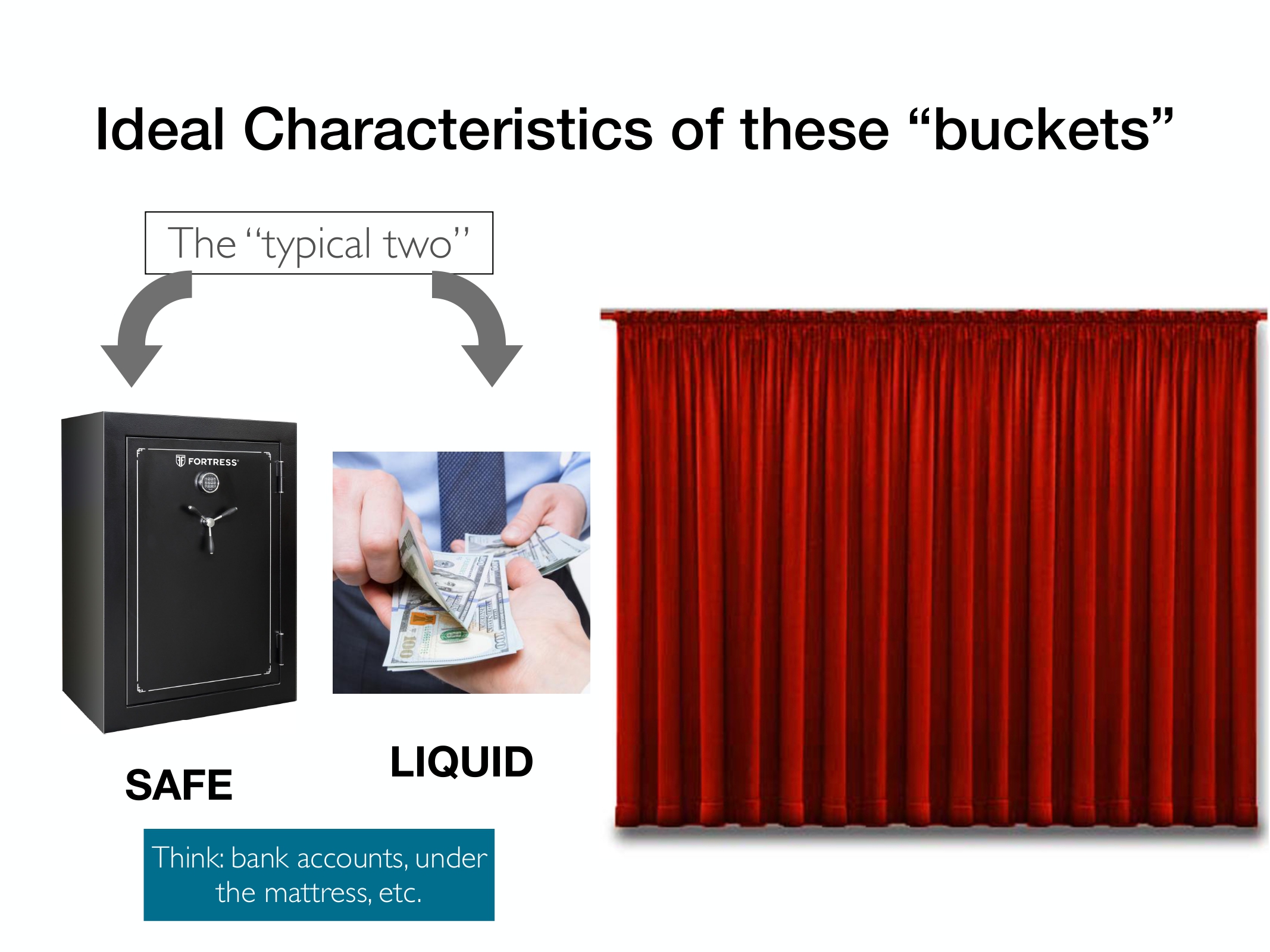

2 Foundational “buckets” of money essential for a sound wealth plan:

1. Emergency Funds

2. Short-term savings –

think:

Vacations

home upgrades

Tax bill

Cars

Etc.

Lifestyle purchases

Ideal Characteristics of these “buckets”

Common Myths

• “If you don’t “Need” life insurance, you don’t buy it.”

• It’s a financial tool. For certain jobs, it is second to none. You may not “need” it, but you sure might want it.

• Term insurance is the “cheapest”

• Depends on how you calculate cost. Permanent plans can be designed to profit beyond all costs very quickly

• Life insurance is an investment

• It’s an asset

• One type is best

• There is no one “best” policy. It’s all about fitting the right product design for the goals and purposes.

Other benefits:

• Guaranteed insurability

• Ability to add to and grow with them

• Transferable

• Can be paid up – 10 pay, 20 pay, and just about any time.

• Or or self-funded via dividends

No Comments